our Co-workers

Professional team members have decades of experience in private equity, venture capital, investing and investment.

About Our Company

Europroperty Investment Fund Management Plc. headquarter in Budapest and looking investment mainly in and around in the capital, wants to become leading independent real estate developer and manager in Hungary. Our aim is to demonstrate that our experience and capabilities can deliver safe and favorable returns for our investors in this rapidly changing market environment.

Europroperty is complies with the relevant European Union regulations, governance, evaluation and reporting guidelines.

Our purpose

The Europroperty Investment Fund Management Plc. manages, develops and operates a premium real estate portfolio. Our aim is to build an alliance with our investors, that delivers the highest returns possible through the safest risk-sharing. Our portfolio consists of unique, professionally executed real estate, luxury homes, premium offices and industrial parks in the best locations in Hungary and the region. These development and operation we consider the growth of invested capital and profit generation to be primary importance. We provide security and transparency to our business partners and investors while sharing the burden of individual risk-taking. Our experts, management providing with decades of international and domestic experience tailor-made solutions to our premium quality private equity investor partners.

Presentation of the Real Estate Investment Fund Management

License number: H-EN-III-395/2018

As an AIFM below the limit, the Company shall have all the personal, material, technical, IT and security conditions required for its operation, as required by the legal acts governing the company. Following the commencement of its operation, the Company shall continue to monitor and where necessary extend these terms and conditions in order to ensure continued compliance.

Based on the foregoing the company has a so-called “Bank of Hungary” authorization to carry out the activities of Hungarian National Bank acting as the supervisory authority of the financial intermediary system (hereinafter the Supervisory Authority or the MNB). It acts as an AIFM below the limit (without voluntary subordination).

our Co-workers

Professional team members have decades of experience in private equity, venture capital, investing and investment.

CEO

After graduating from the College of Finance and Accounting, Péter worked various position at OTP Bank Plc., then from 1997 was responsible for the accounting tasks of MKB Securities and Investment Plc. After the merger of the brokerage firm into the bank, he performed middle management tasks in the financial-accounting area of MKB Bank. After 2008 he has been co-manager and financial director of subsidiaries related to MKB Bank’s large corporate work-out. After the disinvestment of MKB Bank’s real estate portfolio, he became the member of the Board of Directors and the Chief Operating officer of MSZVK (Hungarian Resolution Asset Management Plc.) and its subsidiaries. Since the establishment of our company, he has been a member of the Board of Directions.

Supervisory board member

Sándor studied at the Marx Károly University of Economics. In the 1990s, he was responsible for managing the investment portfolio of the largest Hungarian commercial bank at MHB Bank Group as CEO of MHB invest: managed about 100 investments. He participated in the founding of the Budapest Stock Exchange. Between 1997 and 2003 he was responsible for preparing investments, conducting, conducting of privatization and advising on investments for the Wallis Group. Between 2004 and 2007 as Chief Executive Officer of the Treasury Directorate he was responsible for representing the tens of thousands of billions of HUF worth of real estate in the Hungarian State, through about a thousand trusts. In 2008 he headed the Cabinet of Ministers of the Ministry of Finance, then represented the Hungarian State in the Board of Directors of Péti Nitrogénművek Plc. Between 2011 and 2017 he is the Head of Construction and Operation of a Retirement Home.

Supervisory board member

Zoltán graduated from the Faculty of Business Administration of the Budapest University of Economics. After his university studies, he worked as an investment manager at ING Bank, then he was a senior consultant at McKinsey and Co. for two years. Between 2005 and 2008 he was the retail director and specialty of MKB Bank, his main task was to organize and supervise sales, although he became the sales director of Erste Bank Hungary Plc. role as Level 1 Board Executive. Since 2009, in addition to his work, he has been a Co-Founder and Partner at the Hungarian Enterprise Development Institute Ltd., where he is an independent banking expert and consultant in the financial sector of the region.

Supervisory board member

Krisztián graduated from the Faculty of Economics of the Budapest University of Economics. In addition to his university studies, from 1997 to 2000 he worked as a securities trader at First Hungarian-English Broker Lc. In the field of stock exchange, over-the-counter and government securities. Since 2000, he has been the head and then the director of network sales at Erste Bank Befektetési Plc. Its main task was to organize and support the network sales of investment funds. From 2007, he worked for Erste Bank Hungary Plc. From November 2010, he was the head of the project preparing the establishment of the Erste Group's housing savings fund, and from 2011 he was the CEO of the newly established Erste Lakástakarék Zrt. He was directly in charge of business areas, strategy, product development, business analysis and sales. From 2018, he will be the product development manager of OTP Lakástakarék Zrt. From February 2021, Budapest Bank Zrt. Will lead the product development area of retail mortgage loans.

Back office leader

She graduated in 2015 at Ganz Abraham Bilingual Secondary Vocational School then worked as an office management assistant and later as a corporate control assistant at Seratus Real Estate Ltd. She has a degree in Economics and Management.

Junior investment specialist

He graduated in 2010 at Madách Imre Gymnasium of Vác, then worked as an purchase Manager at MVM Ovit Plc. for 4 years. Then he worked as a personal assistant at Nipüf Plc. He has a dergee in International Management.

Reports, information and regulations of Europroperty Investment Fund Management Plc.

Reports, information and regulations of Europroperty Investment Fund Management Plc. regarding investment funds.

Registration number: 1212-15

One of the aims of the Fund is to purchase domestic real estate in Hungary; Archieve a return on investmen bí improving the tenant mix and reducing operating costs. It also aims to generate returns through ownership of units in other real estate funds, which can be achieved indirectly through property development or property utilization. The Fund aims to generate income.

Industry specification: industrial development area (land), office, hotel, worker, accommodation, retail and wholesale properties.

Valuer of the Fund: EURO-IMMO Expert Ltd. (seat: 1065 Budapest, Nagymező street 4. registry number: 01-09-662724; tax number: 12287189-2-42, represent by: Zalán Novák dr.)

Auditor of the Fund: M-Audit Auditing, Development and Service Ltd. (seat: 1113 Budapest, Karolina street 65. registry number: 01-09-066723; tax number: 10361605-2-42)

Custodian of the Fund: MBH Bank Plc. (Seat: 1056 Budapest, Váci street 38. registry number: 01-10-040952)

Registration number: 1221-40

The purpose of the Fund is to sell the existing real estate assets at the highest available market price, then to liquidate the Fund after the full sale of the real estate assets, and to distribute the assets among the investors. Until the sale of the excisting properties, the will use them in accordance with the investment principles. The Fund Manager may not use the Fund's funds to purchase real estate beyond the existing real estate assets and shall invest the capital recived from the sale of existing real estate or real estate in the Fund's portfolio in accordance with the provisions of the Management Regulation.

Valuer of the Fund: Colliers Hungary Ltd. (seat: 1124 Budapest, Csörsz street.41., registry number: 01-09-166209)

Custodian of the Fund: ERSTE Bank Hungary Plc. (seat: 1138 Budapest, Népfürdő street 24-26. registry number: 01-10-041054)

Auditor of the Fund: M-Audit Auditor, Development and Service Ltd. (seat: 1113 Budapest, Karolina út 65. registration number: 001310)

Registration number: 1222-59

The objective of the Fund is to purchase plots and real estate in Hungary area, primarily, but not exclusively, in Budapest priority districts, to develop the development concept after the purchase, to conduct building permit procedures in accordance with the concept, and subsequently to carry out value-adding real estate developments, as well as to sell the developed properties. Another objective of the Fund is to purchase well-located properties (buildings) located in Budapest and the county seat, to develop the development concept after the purchase, to conduct building permit procedures in accordance with the concept, then to carry out value-adding real estate developments/renovations/reconstructions, to reposition the property, and then to sell the properties.

The Fund strives to increase value through the implementation of developments.

Industry specification: residential properties, industrial development plots, office or retail mixed office properties, hotel and other commercial accommodation, retail and wholesale properties.

Valuer of the Fund: Colliers Hungary International Real Estate Agency Ltd. (registered office: 1124 Budapest, Csörsz utca.41., company registration number: 01-09-166209)

Custodian of the Fund: MBH Bank Plc. (registered office: 1056 Budapest, Váci utca 38. Company registration number: 01-10-040952)

Auditor of the Fund: Multiservice Ltd. (registered office: 1134 Budapest, Kassák L. u 56. tax number: 10684841-2-41; company registration number: 01-09-162263)

Company Details, contact us

Name: Europroperty Investment Fund Management Private Limited Company

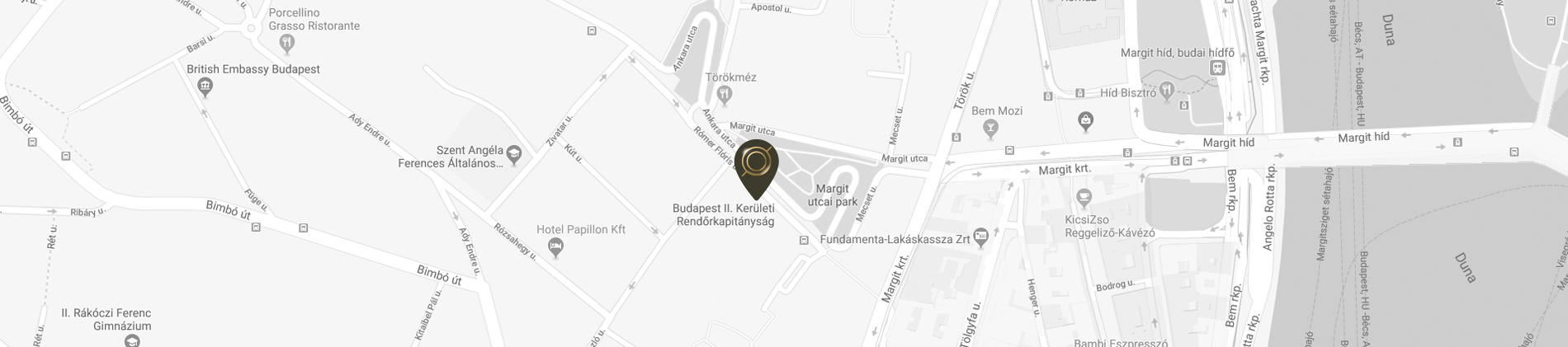

Seat: 1024 Budapest, Rómer Flóris street 8.

Telephone: +36 30 999 1414

Law enforcement agencies: Metropolitan Court of Registration

Registry number: 01-10-049645

MNB license number: H-EN-III-395/2018

Statistical number sign: 26211530-6630-114-01

Tax number: 26211530-1-41

Capital pursuant to Act XVI of 2014 on Collective Investment Undertakings and their Managers and Amendments to Certain Financial laws (1) (53) of the Civil Code Act: 100 dematerialized ordinary shares with nominal value of HUF 1 million each, at 120% issue value. (100M share capital+20M capital reserve)

Cash flow indicator: 116000006-0000000-83827864

Main activity: 6630 ’08 (fund management)

Other activities:

- 64.99 ’08 M.N.S other financial intermediation

- 66.12 ’08 Securities and commodities brokerage

- 66.19 ’08 Other auxiliary financial activities

- 7022 ’08 Business and other management consultancy

- 6920. ’08 Accounting, bookkeeping and auditing activities

Europroperty Investment Fund Management Private Limited Company

Seat: H-1024 Budapest, Rómer Flóris street 8.

Telephone: +36 30 999 1414

Telefax: +36 1 700 2470

E-mail: info@eiak.hu

Europroperty Ingatlanalapkezelő Zrt.

Minden jog fenntartva © All rights reserved

Belépés

Jelszó visszaállítása